From Gold Rush to Revenue Share: Tracking 4 Years of NIL Predictions from Opendorse

Jul 09, 2025On July 1st, 2025, as expected, Opendorse released it's four year NIL report (NIL at 4) which was filled with a recap of the 2024-2025 facts and figures that mattered along with a forecast of what the next 12 months could entail.

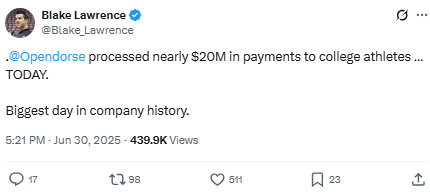

The hype for the report began on June 30th when Opendorse CEO Blake Lawrence tweeted that the platform processed nearly $20MM in payments to college athletes on a single day, a Tweet that garnered almost half a million impressions.

Many took to Twitter to share what stood out from this report, most notably Yahoo's Ross Dellenger who published an excellent thread on what stood out to him the most.

Opendorse has been intentional about publishing these reports annually.

Rather than break down the top takeaways from the NIL at 4 report, we chose to examine how key figures and predictions have changed in each of the annual reports.

To read the past reports, check out these links:

Defining the NIL Reporting Periods

Each Opendorse report uses a July 1–June 30 calendar:

-

N1L (Year 1): July 1, 2021 – June 30, 2022

-

NIL at 2 (Year 2): July 1, 2022 – June 30, 2023

-

NIL at 3 (Year 3): July 1, 2023 – June 30, 2024

-

NIL at 4 (Year 4): July 1, 2024 – June 30, 2025

The real story isn’t just what’s in the latest report. It’s how the numbers have shifted, or not, over time.

Total Market Size: The Forecast Was Way Off (and That's Not a Bad Thing)

In NIL at 2 (published July 2023), Opendorse projected $1.17B in total NIL spend for 2025–26. That was their best guess at the time, based on two full years of data.

NIL at 2 report

By NIL at 4 (July 2025), that forecast had more than doubled, now pegged at $2.75B for the same year.

Inconsistency:

That’s a miss of $1.58B in projected spend, over 130% higher than what they expected two years ago.

Why?

The return of EA Sports, the House settlement, and the formal arrival of collegiate NIL spending fundamentally reshaped the forecast.

Collective Spend: From Market Leader to Rapid Decline

Here’s how collective spend has trended in Opendorse’s reports:

-

Year 1 (2021–22): $321.3M

-

Year 2 (2022–23): $910.9M

-

Year 3 (2023–24): $936.0M

-

Year 4 (2024–25): $1.3B

-

Year 5 (2025–26, projected): $227.3M

Inconsistency:

Collective spend was once expected to keep growing. But between Year 4 and Year 5, Opendorse now projects a drop of over $1B in collective spend. That's an 82% decline in just 12 months.

What used to be the primary NIL channel is now expected to fade fast as schools take over athlete compensation.

NIL at 3 report

Collegiate NIL: A $1.5B Line Item That Didn't Exist Before

In the first three reports, there was no mention of collegiate NIL spend, because it didn’t exist yet.

Now in NIL at 4, it’s projected to lead the market in 2025–26:

-

Collegiate Spend (2025–26, projected): $1.5B

Inconsistency:

That $1.5B line item was a 0 as recently as NIL at 3. That’s not a minor revision, that’s a complete reshaping of the NIL economy.

NIL at 4 report

Commercial NIL: The U-Turn in Brand Spend

Commercial NIL spend was expected to stabilize, maybe even decline slightly. Instead, it rebounded hard:

-

Year 1 (2021–22): $596.7M

-

Year 2 (2022–23): $229.1M

-

Year 3 (2023–24): $234.0M

-

Year 4 (2024–25): $957.4M

-

Year 5 (2025–26, projected): $994.9M

Inconsistency:

From NIL at 2 to NIL at 4, commercial NIL went from an afterthought to a billion-dollar category again.

This shift was likely underestimated in earlier reports. The EA Sports game and stronger brand confidence in NIL are big drivers here.

Athlete Earnings %: One of the Few Consistent Trends

Across all four reports, one thing that has remained steady is how much athletes actually receive from each category:

-

Commercial: Athletes receive ~29%

-

Collective: Athletes receive ~90%

-

Collegiate: Athletes receive ~95%

Consistency:

These distribution ratios haven’t shifted much and remain a useful shorthand when evaluating where the money actually lands.

Six-Figure Athletes: Still Rare, But Impactful

Opendorse tracked 1,000+ athletes who earned $100K+ in NIL since 2021. Of them:

-

69% are still in college

-

19% play professionally

-

10% joined the workforce

-

2% turned pro and retired

Consistency:

That 69% figure has held relatively steady since Year 2, reinforcing a key point: college might still be an athlete’s NIL peak, especially for Olympic and women’s sports.

Women's Sports: From Niche to Flagship

One of the most striking trends: the growth in women's sports NIL value, especially in commercial campaigns.

-

Women's Volleyball NIL Growth:

-

+365% (Year 1 to 2)

-

+123% (Year 2 to 3)

-

+146% (Year 3 to 4)

-

Consistency:

Each report has doubled down on the same point: Women’s sports are consistently overperforming in engagement and ROI, and brands are starting to catch on.

Final Take

The big numbers in NIL have changed drastically in just four years. Some shifts, like collective decline and brand resurgence, were underestimated early. Others, like the explosive rise of school-funded NIL, weren’t even on the radar.

Stay in the loop with key NIL Happenings!

Join our mailing list to receive weekly NIL newsletters on key developments in the NIL landscape.

We love NIL, but hate SPAM. We will never sell your information, for any reason.